Advertisement

-

Published Date

July 10, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

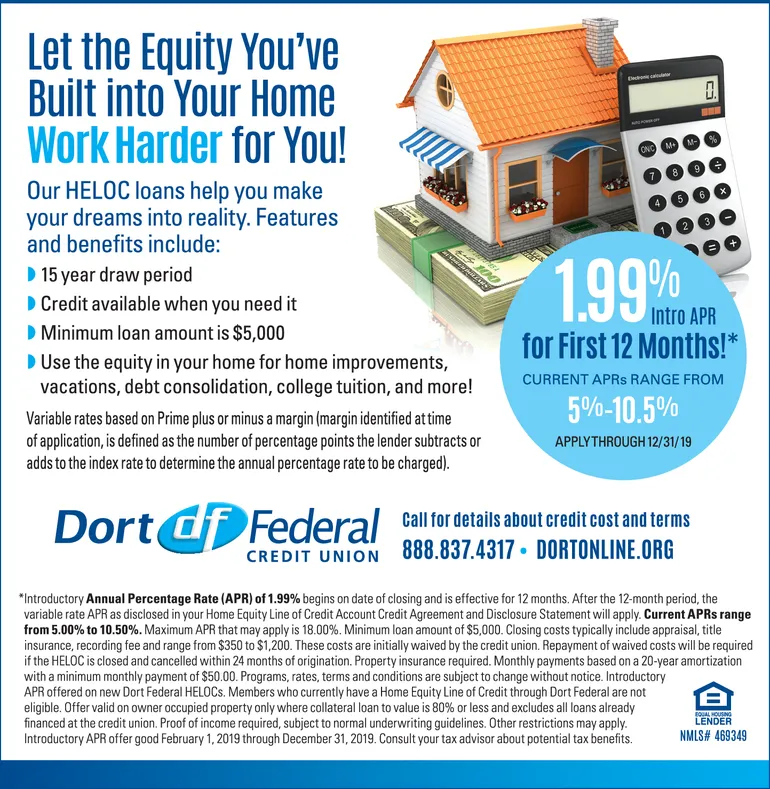

Let the Equity You've Built into Your Home Work Harder for You! Eecn caan M- M+ ONC Our HELOC loans help you make your dreams into reality. Features and benefits include: 9 8 T X 5 4 3 2 1 15 year draw period Credit available when you need it Minimum loan amount is $5,000 1.99f Intro APR for First 12 Months!* Use the equity in your home for home improvements, vacations, debt consolidation, college tuition, and more! CURRENT APRS RANGE FROM 5%-10.5% Variable rates based on Prime plus or minus a margin (margin identified at time of application, is defined as the number of percentage points the lender subtracts or adds to the index rate to determine the annual percentage rate to be charged) APPLYTHROUGH 12/31/19 Dortdf Federal Call for details about credit cost and terms CREDIT UNION 888.837.4317 DORTONLINE.ORG "Introductory Annual Percentage Rate (APR) of 1.99% begins on date of closing and is effective for 12 months. After the 12-month period, the variable rate APR as disclosed in your Home Equity Line of Credit Account Credit Agreement and Disclosure Statement will apply. Current APRS range from 5.00% to 10.50% . Maximum APR that may apply is 18.00 %. Minimum loan amount of $5,000. Closing costs typically include appraisal, title insurance, recording fee and range from $350 to $1,200. These costs are if the HELOC is closed and cancelled within 24 months of origination. Property insurance required. Monthly payments based on a 20-year amortization with a minimum monthly payment of $50.00. Programs, rates, terms and conditions are subject to change without notice. Introductory APR offered on new Dort Federal HELOCS. Members who currently have a Home Equity Line of Credit through Dort Federal are not eligible. Offer valid on owner occupied property only where collateral loan to value is 80% or less and excludes all loans already financed at the credit union. Proof of income required, subject to normal underwriting guidelines. Other restrictions may apply. Introductory APR offer good February 1, 2019 through December 31, 2019. Consult your tax advisor about potential tax benefits. initially waived by the credit union. Repayment of waived costs will be required B BOUAL HOUSING LENDER NMLS# 469349 Let the Equity You've Built into Your Home Work Harder for You! Eecn caan M- M+ ONC Our HELOC loans help you make your dreams into reality. Features and benefits include: 9 8 T X 5 4 3 2 1 15 year draw period Credit available when you need it Minimum loan amount is $5,000 1.99f Intro APR for First 12 Months!* Use the equity in your home for home improvements, vacations, debt consolidation, college tuition, and more! CURRENT APRS RANGE FROM 5%-10.5% Variable rates based on Prime plus or minus a margin (margin identified at time of application, is defined as the number of percentage points the lender subtracts or adds to the index rate to determine the annual percentage rate to be charged) APPLYTHROUGH 12/31/19 Dortdf Federal Call for details about credit cost and terms CREDIT UNION 888.837.4317 DORTONLINE.ORG "Introductory Annual Percentage Rate (APR) of 1.99% begins on date of closing and is effective for 12 months. After the 12-month period, the variable rate APR as disclosed in your Home Equity Line of Credit Account Credit Agreement and Disclosure Statement will apply. Current APRS range from 5.00% to 10.50% . Maximum APR that may apply is 18.00 %. Minimum loan amount of $5,000. Closing costs typically include appraisal, title insurance, recording fee and range from $350 to $1,200. These costs are if the HELOC is closed and cancelled within 24 months of origination. Property insurance required. Monthly payments based on a 20-year amortization with a minimum monthly payment of $50.00. Programs, rates, terms and conditions are subject to change without notice. Introductory APR offered on new Dort Federal HELOCS. Members who currently have a Home Equity Line of Credit through Dort Federal are not eligible. Offer valid on owner occupied property only where collateral loan to value is 80% or less and excludes all loans already financed at the credit union. Proof of income required, subject to normal underwriting guidelines. Other restrictions may apply. Introductory APR offer good February 1, 2019 through December 31, 2019. Consult your tax advisor about potential tax benefits. initially waived by the credit union. Repayment of waived costs will be required B BOUAL HOUSING LENDER NMLS# 469349