Advertisement

-

Published Date

February 28, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

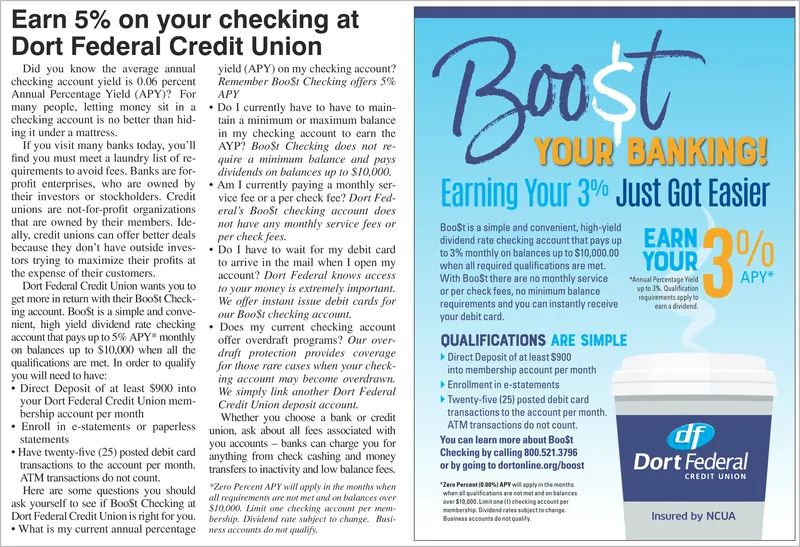

Earn 5% on your checking at Dort Federal Credit Union Did you know the average ann ield (APY) on my checking account? checking account yield is 0.06 percent Remember Boos, Checking offers 5% Annual Percentage Yield (APY)? For APY many people, letting money sit in aDo I currently have to have to main ecking account is no better than hid tain a minimum or maximum balance in my checking account to earn the ing it under a mattre YOUR BANKING! g Your 3o Just Got Easier If you visit many banks today, you' AYP? Boo Checking does no re find you must meet a laundry list of re-quire a minimu balance and pays quirements to avoid fees. Banks are for dividends on balances up to $10,000. a monthly ser- their investors or stockholders. Cedit vice fee or a per check fee? Dort Fed- unions are not-for-profit organizations eras BooSt checking account does that are owned by their members. Ide no have any monthly service fees or profit enterprises, who are owned by Am I currently paying ally, credit unions can offer better deals per check fees. the expense of their customers. ing account. BooSt is a simple and conve our BooSt checking account. BooSt is a simple and convenient, high-yield dividend rate checking account that pays up to 3% monthly on balances up to $10,000.00 when all required qualifications are met. With BooSt there are no monthly service or per check fees, no minimum balance requirements and you can instantly receive your debit card. because they don't have outside inves-. Do I have to wait for my debit card tors trying to maximize their profits at to arrive in the mail when I open my account? Dort Federal knows ace APY* Aenual Percentage Yield up to 3%. Oualkation Dort Federal Credit Union wants you to to yur ney is extremely important. get more in return with their BooSt Check We offer instant issue debit cards for nient, high yield dividend rate checkingDoes my current checking account account that pays up to 5% APY* monthly offer overdraft programs? Our over. OUALIFICATIONS ARE SIMPLE on balances up to $10,000 when all the draft protection provides qualifications are met. In order to qualify you will need to have: Direct Deposit of at least $900 into membership account per month Enrollment in e-statements for those rare cases when your check ing account may become overdrawn. ply link another Dort Federal Direct Deposit of a least $900 into We s your Dort Federal Credit mem bership account per month Twenty-five (25) posted debit card transactions to the account per month. ATM transactions do not count. Union mem Credit Union deposit accoun .En in e-statements or paperless Whether you choose a bank or credit union, ask about all fees associated with You can learn more about BooSt Checking by calling 800.521.3796 or by going to dortonline.org/boost Zero Pereest 10:00%) APY w1pply ane months di Dort Federal you accounts banks can charge you for Have twenty-five (25) posted debit card anything from check cashing and money the account per month. transfers to inactivity and low balance fees. TM transactions do not count. Here are some questions you should CREDIT UNION Zero Percen APY will apply in the months when all requirements are not met ad on balances ever $10,000 Limit one checking account per me- Dort Federal Credit Union is right for you. bership. Dividend rate subject to change. Busi- ask yourself to see if BooSt Checking at aver $10,000. Litone(1) checking accoustper membership Dividend rates sbject to change Business accoumts donst qualify Insured by NCUA What is my current annual percentage ness accounts do not qualifs